|

||||

|

In this Update:

General Assembly Terminates Emergency Declaration, Ensures Key Waivers Remain

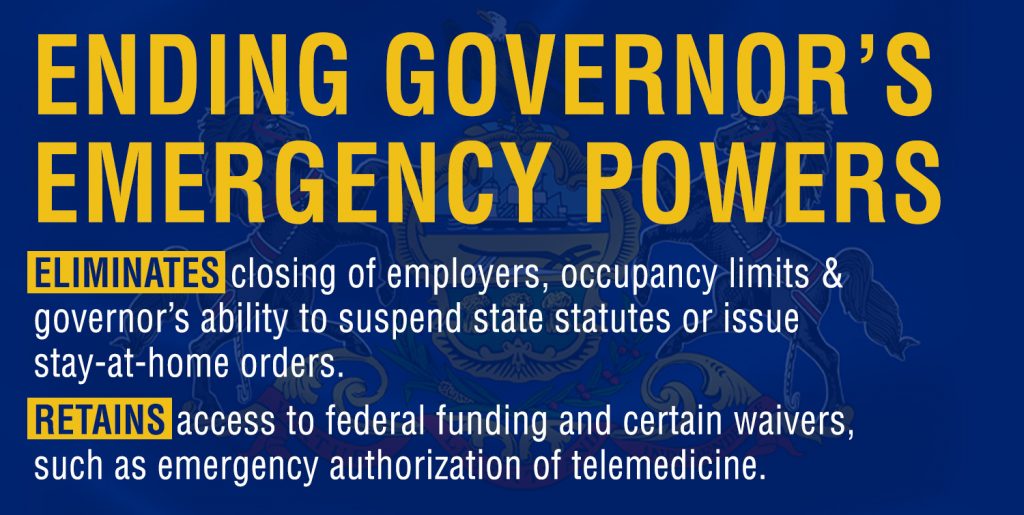

The General Assembly voted this week to end Gov. Tom Wolf’s emergency declaration while ensuring Pennsylvania can take the steps necessary to recover. House Resolution 106 terminates the pandemic emergency declaration and ends the governor’s power to close employers, limit occupancy, suspend state statutes or issue stay-at-home orders due to COVID-19. The measure does not need to go to the governor for enactment. The legislature also approved House Bill 854, which will ensure all waivers that were previously effective under the COVID-19 emergency will remain in effect until Sept. 30, 2021, unless sooner terminated by the authority which initially authorized the waiver. This protects access to critical federal funding and waivers that benefit health and safety, such as the emergency authorization of telemedicine, temporary staffing at nursing homes and personal care homes, and other staffing issues in health care facilities. The bill was sent to the governor for enactment. Voters approved two constitutional amendments in May that limited the length of disaster declarations and gave the General Assembly the sole power to extend a governor’s initial disaster declaration. The General Assembly’s action this week reflects the will of the people and is a necessary step to help the Commonwealth transition out of crisis. Senate Votes to Rein in Health Secretary’s Power, Ban Vaccine Passports

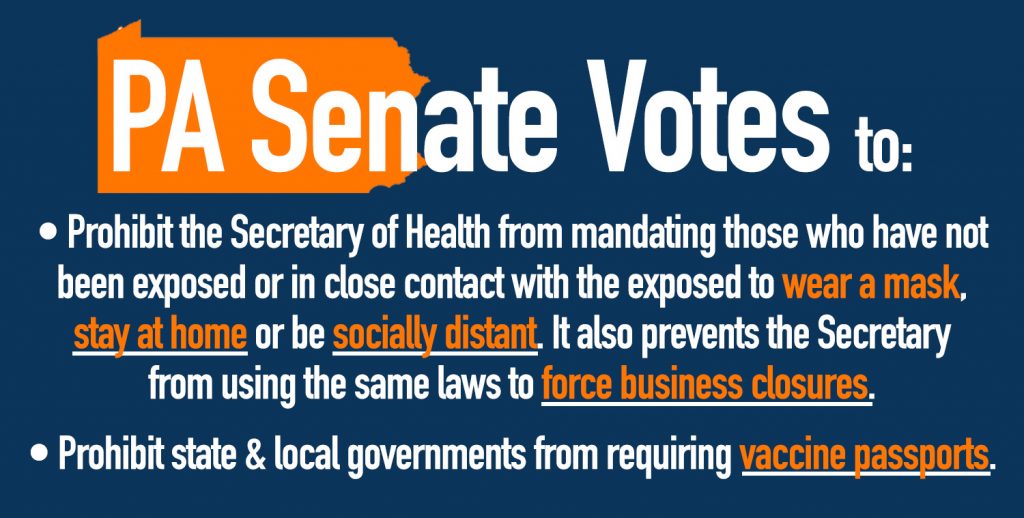

Legislation to prevent the excess use of power by the state Secretary of Health and prohibit vaccine passport requirements was approved by the Senate. The bill prohibits the Secretary of Health from using the 66-year-old Disease Prevention and Control Act to mandate those who have not been exposed or in close contact with the exposed to wear a mask, stay at home or be socially distant. It also prevents the secretary from using the same laws to force business closures. It also prohibits the state – as well as counties, municipalities, school districts and colleges that are subsidized by state taxpayers – from requiring proof of vaccination. The measure was sent to the House of Representatives for consideration. Bartolotta Bills Pass Committee, Headed for Senate VoteThis week, Senate committees passed three important bills which I have sponsored. Senate Bill 368, which I am sponsoring with Sen. Judy Ward (R-30), would provide employers impacted by the COVID-19 pandemic with critical assistance. It would permit small businesses to take a net loss against other sources of income and to “carry back” losses to previous tax years. It would also allow employers to take Net Operating Losses against future years for up to 20 years. The changes would give small business owners the option to benefit from the same tax strategies as large corporations and provide the same immediate relief that is offered at the federal level. Senate Bill 725 would allow farmers to use a Class C driver’s license when operating farm vehicles with a combined weight of more than 26,000 pounds on roadways. Act 170 of 2014 clarified that farmers did not need a Commercial Driver’s License (CDL) when operating farm trucks, or farm trucks hauling trailers, with a combined weight of more than 26,000 pounds. However, it was unclear as to whether a farmer could use a Class C or Class A driver’s license when operating those vehicles, and state police have been requiring farmers to have a Class A to avoid a citation. Senate Bill 578, which I am sponsoring with Sen. Elder Vogel (R-47), is a constitutional amendment that would expand property tax relief for Pennsylvania’s disabled veterans. Currently, honorably discharged veterans must be 100% disabled and have a financial need to receive a 100% exemption from property taxes. The measure expands the state’s program to the unmarried surviving spouse upon the death of an eligible veteran and also eliminates the “War Time” Clause so that the injury does not have to occur during a war for a veterans to be eligible for the exemption. Since all bills received committee support, the legislation now moves to the full Senate for consideration. Working to Reform Our Election SystemsThank you to everyone who has reached out with election integrity and reform concerns. We all agree on the need to move forward in a way that is transparent, responsible and effective. I have signed on in support of legislation to implement voter identification via a constitutional amendment, which would ultimately allow citizens to decide at the ballot box if they want voter identification in the Commonwealth. I am also supporting a measure that would ensure accuracy of voter registration records. Specifically, this measure would incorporate into law recommendations made by the Auditor General Timothy DeFoor in his report of the Statewide Uniform Registry of Electors (SURE), which is the program the Department of State uses to maintain a complete list of all Pennsylvania’s registered voters. This is an important starting point to ensuring we can once again have elections that are free from the shadow of doubt that has been cast over our democratic process. I am committed to supporting reforms to make sure what happened in 2020 never happens again. Increasing Community-Based Services in Schools

The Senate voted to establish the Community Engaged Schools for Success Pilot Program to encourage community partners to work with schools to provide student support services. Designated schools that qualify would be eligible for grants from the Department of Education to appoint a manager and a coordinator to implement community engagement plans. Physical and behavioral health resources, as well as basic needs such as food and clothing, can be provided to students more quickly if they are available at the school. The legislation was sent to the House of Representatives for consideration. Property Tax/Rent Rebate Program Application Deadline Extended

The deadline for older and disabled Pennsylvanians to apply for rebates on rent and property taxes paid in 2020 has been extended from June 30 to Dec. 31, 2021. The Property Tax/Rent Rebate Program benefits eligible Pennsylvanians age 65 and older; widows and widowers age 50 and older; and people with disabilities age 18 and older. The income limit is $35,000 a year for homeowners and $15,000 annually for renters, and half of Social Security income is excluded. Applications can be submitted online with the Department of Revenue’s myPATH system. Filing online leads to fast processing, easy direct deposit options and automatic calculators that help with the process. Something to Celebrate this Flag Day

June 14, Flag Day, commemorates the 1777 adoption of the Stars and Stripes as the official flag of the United States. It has grown to mean more than simply the celebration of a banner. This spring, as we head back outside and reconnect with neighbors, the flag symbolizes what unites us. Despite our differences, we share the unbreakable bond of citizenship in the greatest nation on earth. Fly our flag with pride, gratitude and love of neighbor. U.S. Army Marks 246 Years of Defending America

“Resolved, That six companies of expert riflemen [sic], be immediately raised in Pennsylvania, two in Maryland, and two in Virginia; … [and] that each company, as soon as completed [sic], shall march and join the army near Boston, to be there employed as light infantry, under the command of the chief Officer in that army.” – Continental Congress resolution, June 14, 1775 For 246 years, the U.S. Army has defended the nation and the free world as a fierce fighting force noted for its power and bravery. It’s an honor to recognize the Army’s June 14 birthday, as well as the dedicated men and women who give it its strength all year round. |

||||

|

||||

Want to change how you receive these emails? 2025 © Senate of Pennsylvania | https://www.senatorbartolotta.com | Privacy Policy |