|

View this email in a browser

In this Update:

- Senate Passes New Funding for Hospitals, Health Care Workers

- Senate District Overwhelmingly Supports State Spending Limits

- Join My Telephone Town Hall Meeting on Feb. 10

- Student Loan Relief for Nurses Available through March 1

- Senate Acts to Improve PA National Guard Health Care

- Property Tax/Rent Rebate Applications Being Accepted

Senate Passes New Funding for Hospitals, Health Care Workers

The Senate this week approved critical funding for hospitals and frontline health care workers who continue to keep Pennsylvanians safe during the COVID-19 pandemic. The bill was sent to the governor for enactment.

It allocates a total of $225 million to hospitals and their employees. The additional dollars will be allocated as follows:

- $100 million for acute care general hospitals.

- $110 million for critical access hospitals, facilities with a high volume of Medicaid patients, and behavioral/psychiatric providers.

- $15 million for the PA Student Loan Relief for Nurses Program.

The legislation requires the funding to be directed to retention and recruitment programs for staff. Hospital executives and administration, contracted staff and physicians would not be eligible for payments.

Senate District Overwhelmingly Supports State Spending Limits

Recently, I offered a survey to determine the opinions residents in the 46th District have about state spending limits and legislation I am sponsoring. The Taxpayer Protection Act (TPA) is a constitutional amendment that ties the growth of state spending to a combined rate of inflation and population growth.

The survey asked whether respondents support state spending limits. Of the people who answered the survey, 92% said they support spending limits with 8% saying they do not.

As our state spending has more than tripled in the last 50 years and the TPA could help to reverse the trend – as well as prevent future tax hikes – I was happy to know that so many people support my bill.

It is time that Pennsylvania is no longer in the minority of states in having no spending controls in place. According to the Urban Institute, 28 states operate under a tax or expenditure limitation.

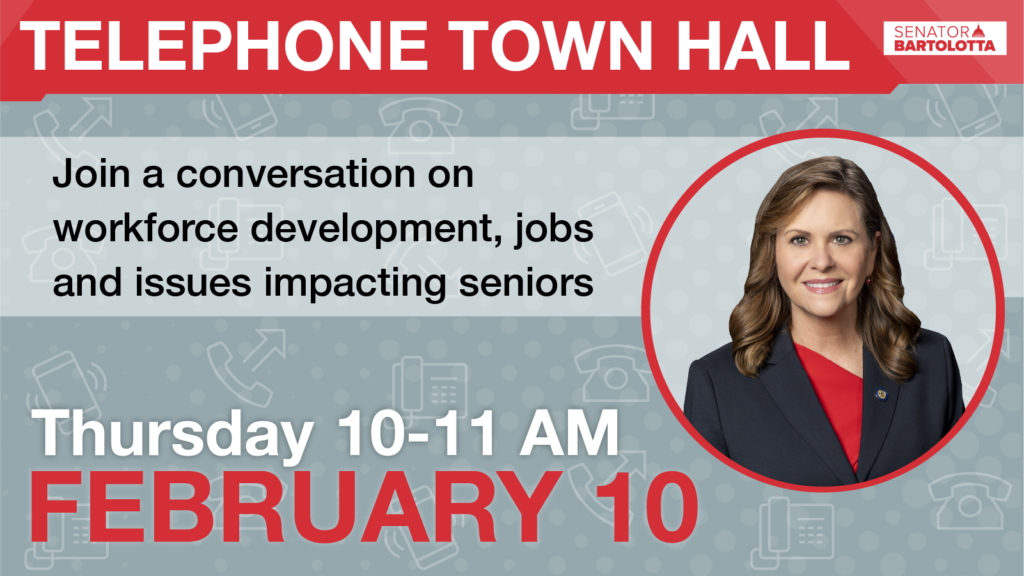

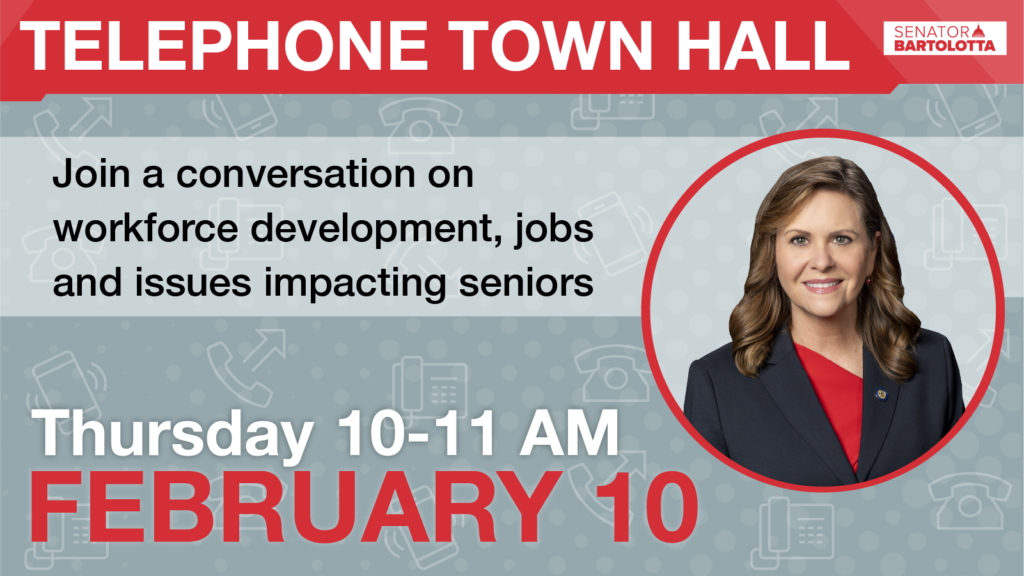

Join My Telephone Town Hall Meeting on Feb. 10

I will be hosting a telephone town hall event for residents of the 46th Legislative District. The program will focus on workforce development and jobs, as well as issues impacting seniors.

Guest panelists will include Ami Gatts, director of the Southwest Corner Workforce Development Board; Leslie Grenfell, executive director for the Southwest PA Area Agency on Aging Inc.; and Jeff Kotula, president of the Washington County Chamber of Commerce.

Community residents can register to participate in the telephone town hall by visiting SenatorBartolotta.com/access-live. This link can also be used for audio streaming, which will be available immediately prior to the event.

Student Loan Relief for Nurses Available through March 1

Applications are being accepted through March 1 for the new Student Loan Relief for Nurses program.

Qualified nurses working through the COVID-19 pandemic may be eligible to receive student loan relief of up to $2,500 for each year of work (beginning with 2020) for up to three years, with a maximum benefit of $7,500.

The Pennsylvania Higher Education Assistance Agency indicates the high volume of applications has slowed the review process, and online applications are not offered. You can learn more about the program and the application process here.

Senate Acts to Improve PA National Guard Health Care

Legislation to increase the number of health care providers in the Pennsylvania National Guard was approved by the Senate. The bill was sent to the House of Representatives for consideration.

The legislation improves the Medical Officer or Health Officer Incentive Program, which was created in 2014 to provide an education stipend to those who qualified through their time in the armed services.

This incentive program began to address the lack of health care providers within the Guard. However, some health professionals, such as dentists and physician assistants, were inadvertently left out of the program.

Senate Bill 927 would establish a broader definition of “health professional” to capture those left out of the original program. It would also create education stipend tiers based on the participant’s education level, so that physicians and physician assistants would get a higher reimbursement to help pay down their higher tuition debt.

Property Tax/Rent Rebate Applications Being Accepted

Older and disabled Pennsylvanians can apply now for rebates on property taxes or rent paid in 2021.

The Property Tax/Rent Rebate Program benefits eligible Pennsylvanians age 65 and older, widows and widowers age 50 and older, and people with disabilities age 18 and older. The income limit is $35,000 a year for homeowners and $15,000 annually for renters, and half of Social Security income is excluded.

After checking eligibility requirements, you can file your rebate application online by visiting mypath.pa.gov. Submitting your application online does not require you to sign up for an account. You can check the Property Tax/Rent Rebate Program instruction booklet to learn which information you will need to complete the process.

|